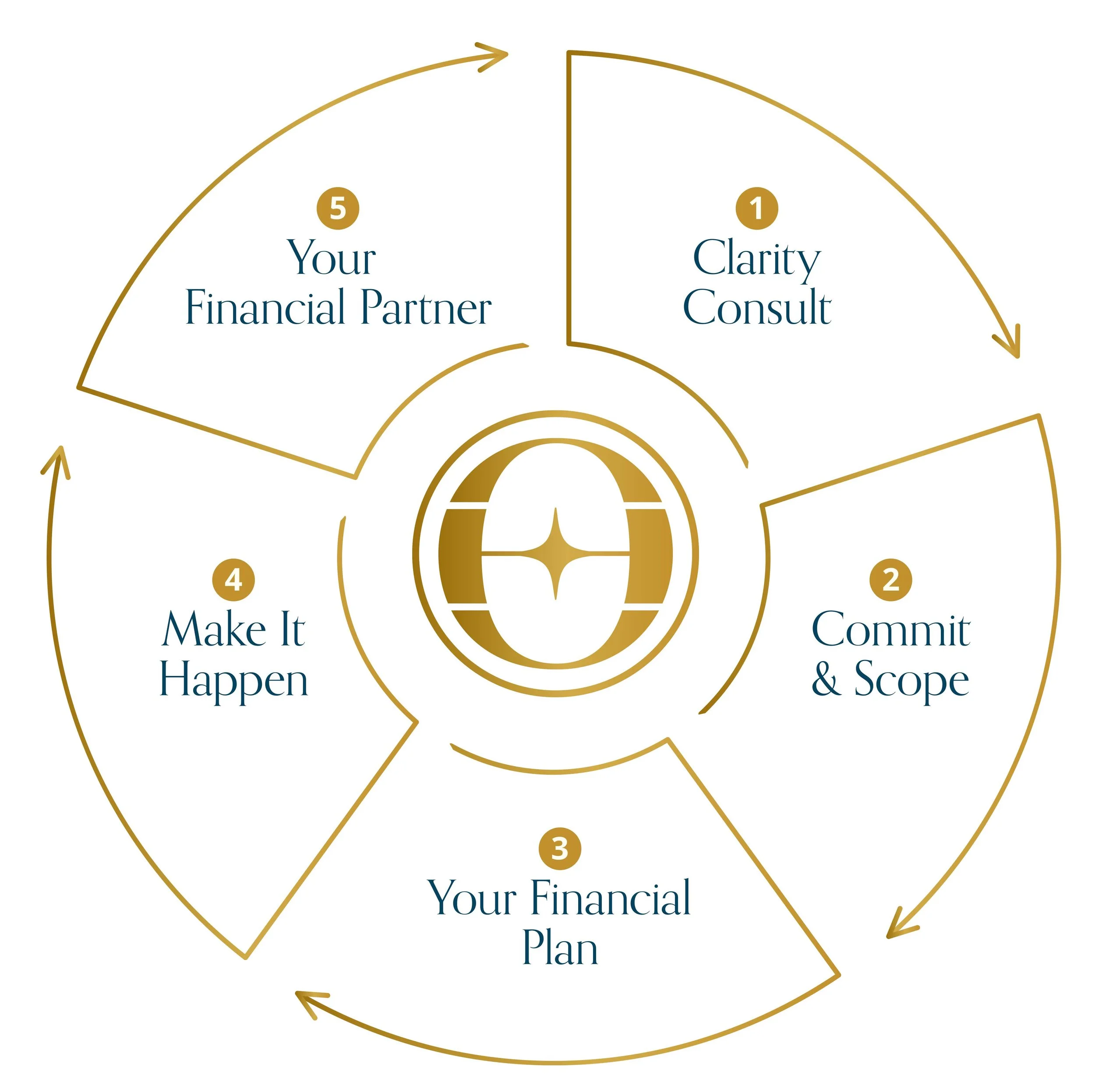

Our Approach: The Steady Path Framework.

We keep things clear, steady, and strategic. No jargon. No flashy shortcuts. Just a proven process that’s helped hundreds of Australians move from money worries to financial confidence.

We call it the Steady Hand Framework — because when it comes to your money, you want a safe pair of hands guiding every step…

The Steady Path Framework

-

60-minute consultation - $495

A one-hour conversation where we look at your situation and answer your most pressing questions. You’ll walk away with clear direction and practical next steps with general advice that is specific to you

If you do become a client, we'll deduct this fee from your financial plan cost.

-

Letter of engagement

We'll outline exactly what we'll do for you, how long it will take, and what it will cost. Everything is transparent from the start so you can make an informed decision about moving forward.

-

Statement of Advice

We present you with your Statement of Advice — your personalised plan that covers super, investments, property, retirement income, and more. Every recommendation is explained in plain English so you know what we’re suggesting and why.

$4,400 for Statement of Advice

($3905 + GST with the clarity consultation fee applied) -

Implementation

This is where plans become reality. We handle all the paperwork, coordinate with super funds and investment platforms, and deal with the technical details. You don't need to become a financial expert - that's our job.

We keep you informed at every step without drowning you in details. When something needs your attention or signature, we'll explain exactly what it is and why it matters.

-

Ongoing support & reviews

Life changes. Markets move. Rules get updated. We stay on top of it all so you don't have to.

Regular reviews ensure your plan stays on track, but we're also here for the unexpected moments.

You'll have direct access to us, not a call centre. When you have a financial question, we're your first call.

What's included:

Annual strategy reviews

Ongoing portfolio management

Market update communications

Direct access for questions

Proactive contact when rules change

Coordination with your accountant and other professionals

Annual fee: From $3,600 (minimum $300 per month)

Financial planning fees can be paid direct or via your superannuation fund

What to expect from Howard Osmond Wealth

Boring advice that builds wealth

No hype. Just proven approaches that quietly build wealth.

Straight talk

We’ll always tell you the truth, even when it’s not what you hoped to hear.

Clarity, not jargon

We explain everything in plain English. If it’s complicated, we’ll make it simple.

A steady hand

We’ve guided clients through every market cycle, rule change, and panic headline. Many of our clients have been with us for decades.

What we're definitely not

Not gamblers

We don’t chase hot tips or the latest fad. That’s not how you build lasting wealth.

Not fair-weather advisers

When markets wobble or life gets messy, we don’t disappear. That’s when we matter most.

Not intimidating

Money is personal. We’ll never make you feel silly for asking questions.

Not one-size-fits-all

Your plan should match your life, not your neighbour’s.